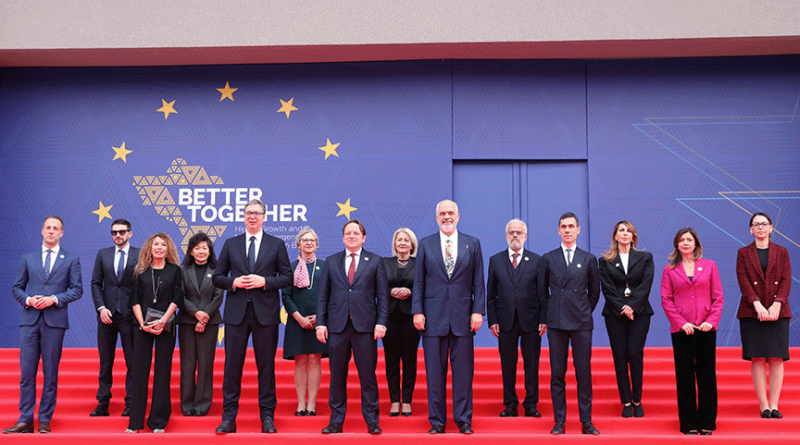

The Western Balkan countries are moving towards European Union accession. Armin Steinbach examines the obstacles and lessons from the Eastern Partnership

Visit our companion website Finance21

Finance21 provides an overview of the financial sector in these turbulent and unique times.

Tax

Broader border taxes in the EU

The EU needs new resources to fund its budget. Pascal Saint-Amans considers the problems of tax leakage and discusses how the EU can access new funds

Taxing the wealthy

Taxing the wealthy effectively and equitably presents a choice between wealth and capital income taxes, each with its own trade-offs. Spencer Bastani and Daniel Waldenström compare the effectiveness of the two forms of taxation

Carbon leakage and international cooperation

Climate change is a collective action problem that requires substantial international cooperation. Christofer Schroeder and Livio Stracca present new evidence that carbon taxes are undermined by ‘leakage’